georgia personal property tax exemptions

The exemption is 2700 for single filers heads of households or. Property Tax Millage Rates.

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

The Federal Income Tax however does allow a personal exemption to be deducted from your gross income if you are responsible for supporting yourself financially.

. Georgia business personal property tax exemptions 2019 City of Brunswick Property Taxes Were Due 11252019 View and Pay Tax Garbage Bills New Please be advised that we are currently experiencing project delays concerning all CDBG funded programs. Property Taxes in Georgia. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. If so and if you have not remarried your Georgia home is 100 exempt from any property tax. Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption.

Nonprofit organizations rely on property and sales tax exemptions to provide vital services to their clients many of whom are those most in need. 1 A Except as provided in this paragraph all public property. Wealth is determined by the property a person owns.

Aircraft must be manufactured in Georgia. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. Items of personal property used in the home if not held for sale rental or other commercial use all tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value domestic animals in an amount not to.

If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000-- 100000 40 - 2000 02500 95000. B No public real property which is owned by a political subdivision of this state and which is situated outside. The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the ballot in Georgia on November 3 1964 as a legislatively referred constitutional amendmentIt was defeatedThe measure would have exempted personal clothing household items and other personal property in Muscogee County from all state and county ad valorem.

State agencies are not exempt from payment of the 3 Second Motor Fuel Tax but are exempt from the additional 1 State sales tax and any of the locally imposed sales taxes. However due to a 2009 Court decision regarding GCN member Nuçis Space in Athens Georgia changes to the definition of organizations of purely public charity could have had drastic effects on many nonprofits ability to receive these. All real property and all personal property are taxable unless the property has been exempted by law.

The amount for 2020 is 98492. Before sharing sensitive or personal information make sure youre on an official. While the state sets a minimal property tax rate each county and municipality sets.

Credit for Tax Paid. When separately state on invoice. 43 - Georgia Dependent Deduction Unlike most states Georgia does not have a dependent deduction.

GA Code 48-5-41 2016 a The following property shall be exempt from all ad valorem property taxes in this state. The value of the property in excess of this exemption remains taxable. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt.

40 of market value times milage average 25 miles Jet Fuel Tax. 48- 5-3 Real property is land and generally anything that is erected growing or affixed to the land. Georgia is ranked number thirty three out of the fifty states in.

Aircraft must be removed upon completion of work. Leading case on whether otherwise exempt property can be used to generate income. Property Tax Homestead Exemptions.

Part 1 - Tax Exemptions. Do senior citizens have to pay property. Occasionally rented to private parties for events eg.

083 of home value. Property tax is an ad valorem tax--which means according to value-- based upon a persons wealth. The state of Georgia has personal exemptions to lower your tax bill further.

Multiply 100000 by 40 which is equal to the assessed value of 40000 and subtract the homestead exemption of 2000 from the. Inventory of finished goods manufactured or produced in Georgia held by the manufacturer or producer for a period not to exceed 12 months. Property exempt from taxation.

Georgia exempts a property owner from paying property tax on. Property Tax Returns and Payment. For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax commissioners office or consult a tax professional.

And federal government websites often end in gov. The tax calculation for the Second Motor Fuel Tax should be based on the purchase price before addition of any State or federal taxes the federal excise tax should not be. 42 - Georgia Personal Exemptions Georgia has no personal exemption.

Tax amount varies by county. Senior citizen exemptions. Inventory of goods in the process of being manufactured or produced including raw materials and partly finished goods.

County Property Tax Facts. If you are 62 years old or older and your annual family income is 10000 or less up to 10000 of your Georgia homes value may be exempt from school tax. Property Tax Proposed and Adopted Rules.

A Level One Freeport Exemption may exempt the following types of tangible personal property. Building held to be exempt where it was owned by a tax - exempt foundation and used for local community musicians and others who come to seek help for anxiety depression or other emotional disorders.

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Benefits Of Owning Rural Land In 2021 Estimated Tax Payments Tax Deductions Business Tax Deductions

Sales Tax Exemption For Building Materials Used In State Construction Projects

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Requirements For Tax Exemption Tax Exempt Organizations

Property Tax Homestead Exemptions Itep

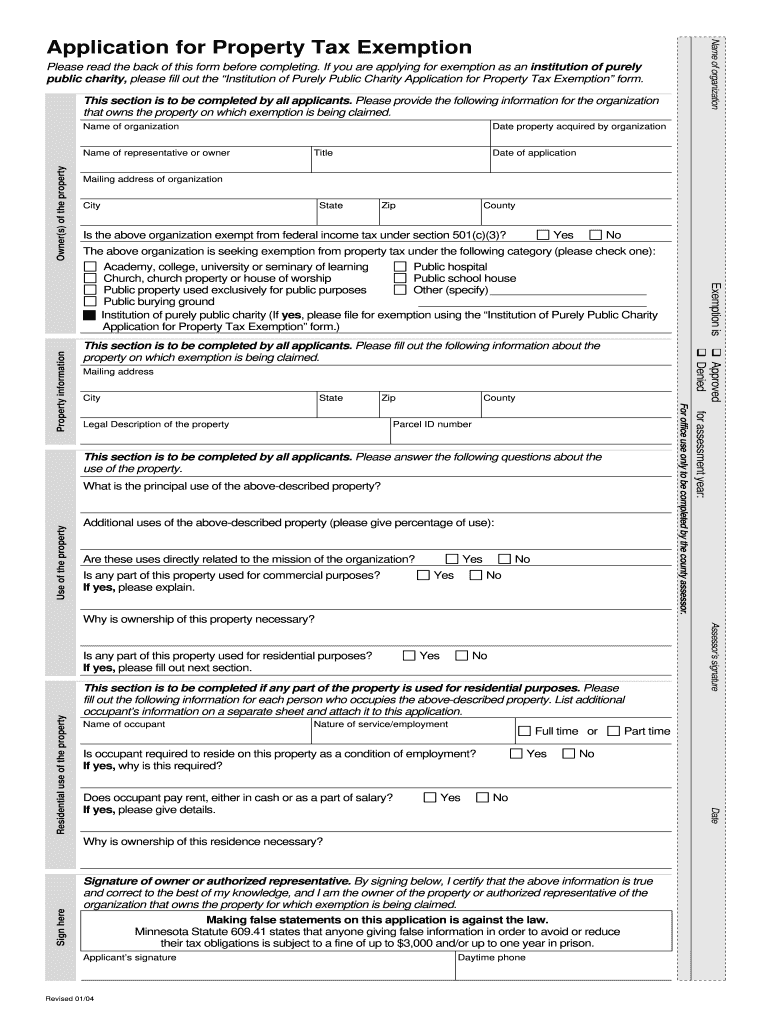

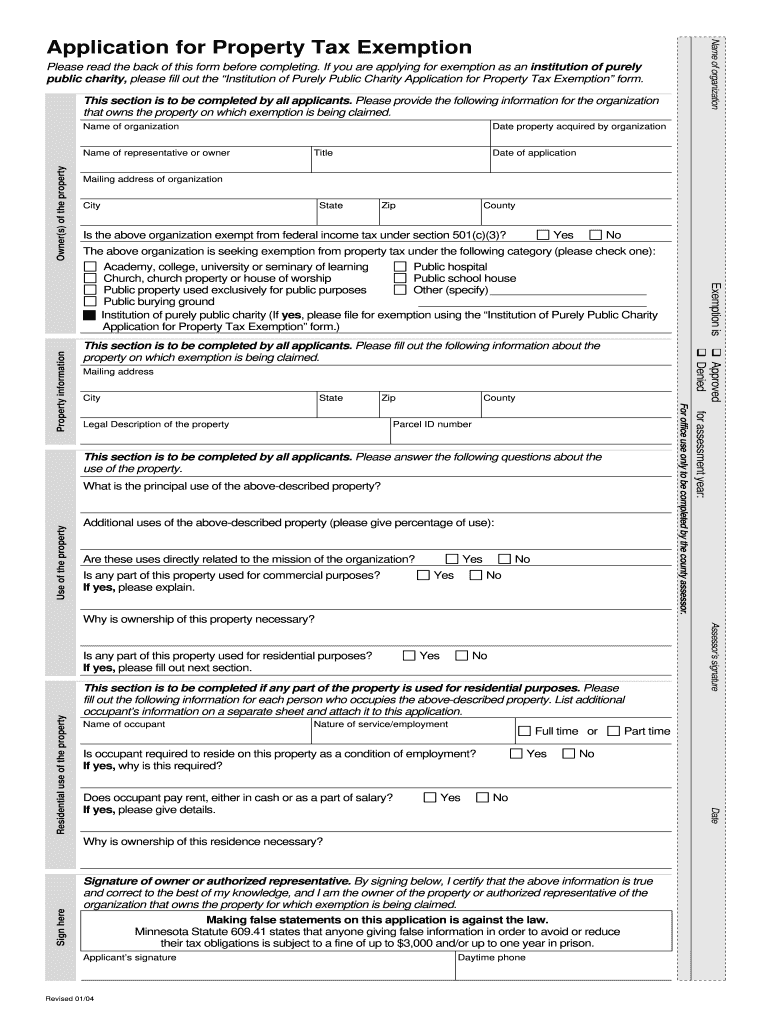

Mn Application For Property Tax Exemption Carver County 2004 2022 Fill Out Tax Template Online Us Legal Forms

What Is A Sales Tax Exemption Certificate And How Do I Get One

A Full Breakdown Of Property Tax Exemptions

Property Tax Comparison By State For Cross State Businesses

Free Zone In Georgia Promotes Easy Business Setup For Offshore Companies Dubai Business Dubai Business Format

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Solar Property Tax Exemptions Explained Energysage

Tax Exemptions Deductions And Credits Explained Taxact Blog

What Is A Homestead Exemption And How Does It Work Lendingtree

Understanding Your Own Tax Return Income Tax Return Tax Forms Income Tax

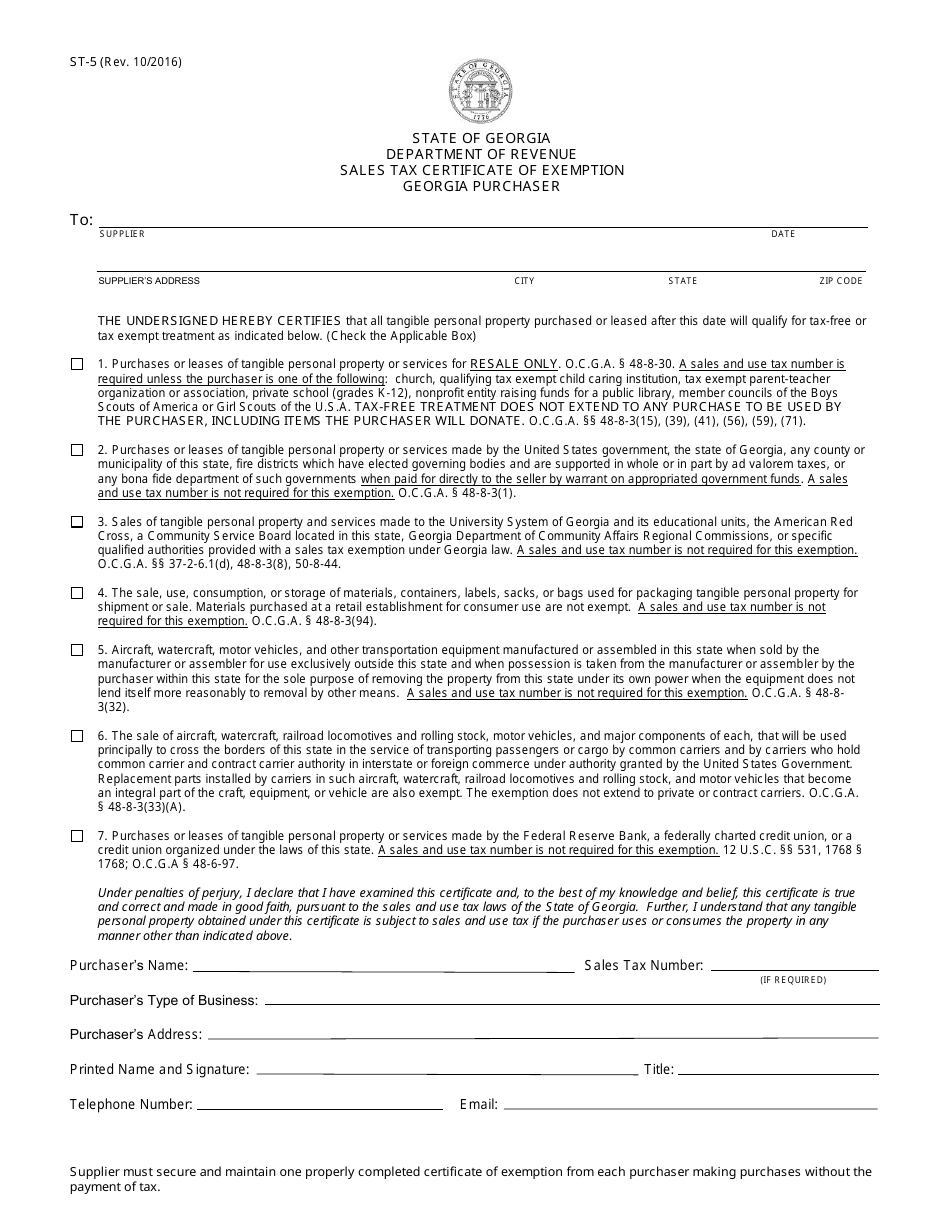

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online